In recent days, gold has reached its highest nominal value in history. To many, this seems like just a speculative detail in the economic news. But for those who understand the fundamentals of economics, this movement reveals something deeper: a monetary confidence crisis on a global scale.

Gold, unlike fiat currencies, cannot be printed by decree. It is scarce, concrete, independent of central banks and governments. And that is precisely why, in times of chronic inflation, wars and trillion-dollar deficits, it returns to center stage.

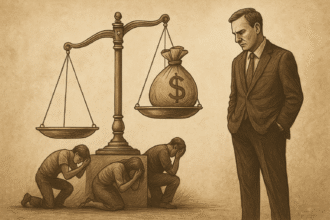

The current appreciation of gold cannot be explained solely by industrial demand or speculative activity. It is the result of fear. Fear of the collapse of the dollar as a global reserve. Fear of fiscal irresponsibility on the part of the United States. Fear of a prolonged war that would further weaken Western economies. Fear that, in the end, central banks will once again give in to the old temptation of printing money as a magic solution.

“Gold is the enemy of the State. It is freedom incarnate.”

– Ferdinand Lips

It is no coincidence that countries such as China, Russia and India have been accumulating tons of gold in their central banks. The movement is silent, but revealing: the world is preparing for a new monetary order, in which gold will once again be the last safe haven.

The rise in gold is therefore a symptom of the disease that plagues modern economies: state hypertrophy and the collapse of monetary discipline.

While the official narrative speaks of growth and stability, the market is sending a clear signal: confidence is dying — and gold is flourishing in its place.