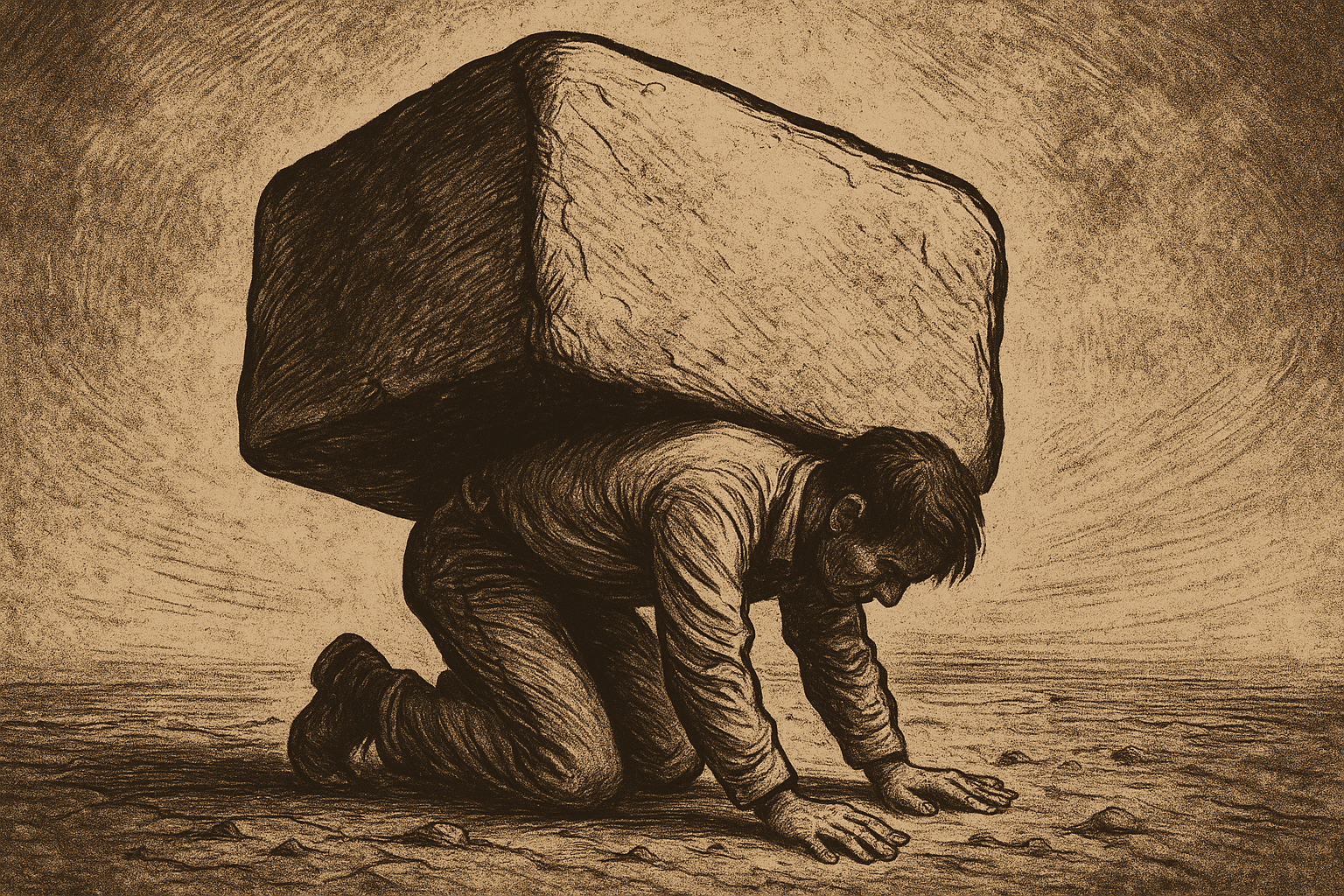

You can ignore inflation, but you can't ignore its effects. It arrives without warning, without a decree, without a headline. It does not need to be voted on or explained. It is the most cowardly of public policies — because it hits first those who can least react. And while it silently erodes workers' salaries, it protects, preserves and even enriches those connected to power.

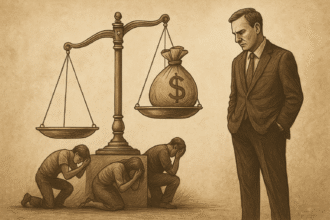

This article is not about inflation as a technical phenomenon, but about its political use as instrument of economic domination and maintenance of privileges. What the State cannot tax directly, it taxes through currency devaluation. And this is called: invisible tax.

What inflation is — and what it is not

Technically, inflation is the generalized increase in prices. But that is just the symptom. What causes this increase, in the vast majority of cases, is the artificial expansion of the monetary base — in other words, the government or its central bank print money too much to finance deficits, manipulate interest rates or fund short-term policies.

This impression, as we have already discussed in Printing Money: What It Really Means, is not a neutral action. The new money enters into circulation benefiting the first to receive it: banks, state-owned companies, public service providers and large suppliers. The latter — salaried workers, small entrepreneurs and retirees — foot the bill.

The State Creates the Problem — and Profits from It

The irony is brutal: the same State that causes inflation also use it as an excuse to justify new interventions. If prices rise, he “needs” to control the market, subsidize sectors and increase taxes to “compensate”. In other words, inflation becomes a pretext for more government.

And what's more: the State benefits from inflation because it dilutes the value of public debt. Since most government debts are pegged to nominal values, devaluing the real means pay less in real terms to domestic creditors, including citizens who buy Treasury bonds as a form of savings.

Who loses first: the informal worker and the salaried worker?

Inflation does not affect everyone equally. It acts as a social poison: invisible, but selective.

The employee with a rigid contract, who does not have an immediate adjustment, loses purchasing power month after month. The informal worker, who depends on daily price variations, loses margin. The small business owner, who is unable to pass on costs quickly, loses competitiveness.

And meanwhile, the shielded castes of high-ranking civil servants, whose salaries are indexed or adjusted annually by “specific laws”, continue to receive systematic adjustments — paid for by the same people who are being silently looted.

Who wins from inflation: the well-connected

Inflation is a tool of regressive redistribution of income. But contrary to socialist discourse, it is not the market that operates this distortion — it is the State, by manipulating the currency and ensuring that the first to receive new money are banks, large business groups and public bodies.

These agents buy assets before prices rise. They invest, hire, expand and protect themselves. When the money reaches the population, prices have already risen — and purchasing power has evaporated.

This process was analyzed in The False Neutrality of State Money: Whoever Controls the Money, Controls You, where we show how the monopoly of monetary issuance serves the perpetuation of an artificially sustained economic elite.

Inflation is the tax without approval

Unlike direct taxes, inflation does not need to be voted on, nor published in the Official Gazette. It can be decided through monetary policy, Central Bank operations or systematic borrowing. It does not require public debate — only the passivity of the population.

That's why it's called the "invisible tax": it It doesn't appear on your pay stub, but it does appear at the supermarket. It is not deducted from your salary, but from your purchasing power. It does not finance health or education, but the payment of debt and the privileges of the shielded castes.

The farce of adjustments and inflation targets

Another perverse aspect is the political use of inflation itself. When the government announces that it will adjust the minimum wage or the welfare benefit based on the IPCA, it sells this as “social justice”. But the IPCA is always lower than the real inflation felt in popular consumption.

The government creates the problem, presents a palliative that does not cover the real loss, and still capitalizes politically on it.

Furthermore, the Central Bank manipulates market expectations with an inflation target that already considers a certain degree of currency devaluation acceptable. In other words: the loss of your purchasing power It's not a flaw — it's part of the plan.

How to protect yourself (and why few people succeed)

In an environment of persistent inflation, protecting yourself requires access to sophisticated financial instruments: inflation-linked investments, dollarized assets, currency hedge funds. But Who has access to these instruments?

- Big banks

- Institutional investors

- High-income public servants

- Businessmen close to power

The ordinary citizen, who can barely save, there is no way to protect yourself. Inflation thus becomes, another mechanism for the concentration of wealth.

Conclusion: the tax that you can't see, but you can feel

Inflation is the most efficient instrument for the silent destruction of people’s income. It is a project of impoverishment disguised as economic fluctuation. It hits the weakest, protects the strongest and anchors a system in which the State wins twice: when it issues and when it taxes.

To ignore this is to accept being looted every day — without knowing exactly by whom. The only way out is to break with the narrative that inflation is natural, inevitable or acceptable. It is not. It is institutionalized theft.

📩 Do you want to understand how power manipulates money to keep you dependent?

Subscribe to the newsletter Economic Radar and receive analyses like this directly in your email. The truth needs to circulate with more force than the devalued currency.