When governments talk about “regulating the digital currency market,” it’s rarely about security. It’s almost always about control.

In this post, we will analyze how the crackdown on cryptocurrencies and alternative payment methods reveals what States fear most: losing their monopoly over money — and, with it, control over their citizens.

👉 Read also: Who Regulates the Regulator? The Closed Circle of State Power

Money has always been a tool of power

Before being a means of exchange, a unit of account or a store of value, money is — and always has been — an instrument of political power.

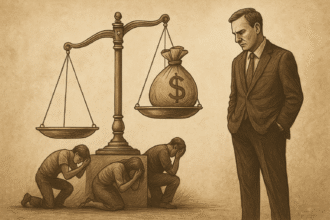

Controlling the currency means:

- Define who is rich and who is poor.

- Deciding who has access to credit and who is excluded.

- Financing wars, projects and privileges without asking society for permission.

The state monopoly on the issuance of money is not an economic necessity. It is a political construction.

The threat of private currencies

The emergence of cryptocurrencies — Bitcoin first and foremost — has offered a real alternative to state money for the first time in centuries.

- A medium of exchange beyond the reach of fiscal printers.

- A censorship-resistant and inflation-resistant monetary system.

- An asset that, in theory, does not depend on trust in governments or central banks.

For those at the top of the state chain, this is not innovation. It's insubordination.

The discourse of security: the new pretext

In recent years, governments around the world have stepped up their crackdown on private currencies.

The pretext is always noble:

- Fight organized crime.

- Prevent money laundering.

- Protect the consumer.

In practice, however, what we observe are attempts to:

- Make anonymity impossible.

- Centralize transaction tracking.

- Require increasingly restrictive licenses to operate platforms and services.

Every new law is sold as “protection” — but its real effect is recentralize monetary control.

CBDCs: The Trojan Horse of Financial Surveillance

At the same time as they fight private currencies, states are racing to launch their own digital currencies — the so-called CBDCs (Central Bank Digital Currencies).

- They will be 100% digital state currencies.

- They will allow you to track every penny spent, saved or transferred.

- They will give the State the technical capacity to impose negative rates, freeze balances or restrict purchases with a simple software command.

Imagine a system where:

- Your money has an expiration date.

- You can only spend according to “green” or “socially responsible” guidelines.

- Your spending habits determine your social credit score.

This is not a distant future. It is the open plan of several central banks — including Brazil's, with the digital real project.

Financial freedom is political freedom

Whoever controls your money controls your choices:

- Where you can live.

- What kind of work can you accept?

- What ideals can it support.

Private currencies threaten this control because they return to the individual the sovereignty that the state has monopolized for centuries.

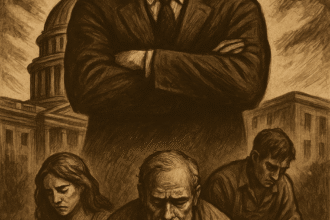

It is no coincidence that Those who attack cryptocurrencies the most are the most indebted and centralized governments.

Conclusion: protecting money is protecting freedom

The battle for the future of money is not just a technological issue.

It is a battle for individual freedom against state expansionism.

- Defending private currencies is defending autonomy.

- To question the monopoly of money is to question the monopoly of power.

- Rejecting financial surveillance is reaffirming the right to exist outside the tracks imposed by the State.

Economic freedom and monetary freedom go hand in hand.

Whoever gives up control of their money, sooner or later gives up control of their life.

📩 Do you want to better understand how the State uses inflation, debt and now monetary surveillance to expand its dominance?

Subscribe to the Economic Radar newsletter and receive critical and direct analysis in your email.