They say the Central Bank is independent. But independent from whom? From politics — or just from the people?

In this post, we will analyze what “Central Bank independence” really means and why, even with formal autonomy, the Brazilian Central Bank remains vulnerable to pressures from the government, the market and an unsustainable fiscal logic.

👉 Read also: The State Against Money: How the War on Private Currency Threatens Your Freedom

The promise of independence

Approved in 2021, the so-called “independence of the Central Bank” was presented as a technical shield against political interference.

The idea was simple:

- Give to BC fixed term, separate from the electoral cycle.

- Allow monetary policy to be conducted with a focus in currency stability.

- Prevent governments from using the bank as a tool to finance deficits or manipulate the economy.

In theory, everything is fine.

In practice, not so much.

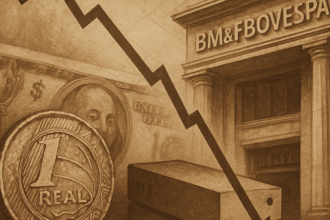

When independence collides with fiscal reality

In a country where:

- The government spends more than it collects,

- Public debt grows year after year,

- Congress pushes for low interest rates to keep populisms viable,

… the technical independence of the BC becomes a fine line.

Every decision to maintain or cut the Selic rate becomes a political target.

And the same government that says it “respects the autonomy of the BC” also insinuates that:

- High interest rates are sabotage,

- Inflation is the market's fault,

- The monetary authority should “collaborate with growth”.

The BC is independent — but not isolated

Even with a technical mandate, the Central Bank:

- You need to justify your decisions to the Senate,

- Acts under pressure from the Executive,

- It is a daily target of political narratives.

And the most serious: operates in an environment where fiscal policy is disastrous.

How to control inflation if the government:

- Spends billions on exemptions and subsidies,

- Refuses to cut fixed expenses,

- Increases debt and postpones reforms?

Without fiscal responsibility, monetary policy becomes damage containment.

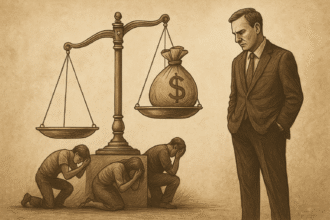

The interest rate trap as the villain

Populist politicians have created an easy enemy: interest rates.

According to them:

- The high Selic rate impedes growth.

- The Central Bank suffocates the economy.

- The monetary authority acts “against the people”.

But they forget to say that:

- Interest reflects the risk of lending to the State.

- The BC only responds to inflation created by the government itself.

- The best way to have low interest rates is… spend less and collect more.

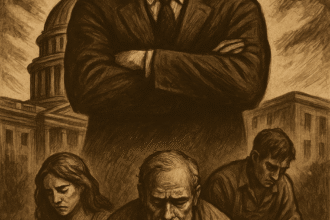

The independence that the market respects — but the State ignores

The market demands predictability.

The State demands complacency.

And the BC, in the middle, needs to:

- Maintain credibility with investors,

- Contain inflation without paralyzing the economy,

- Surviving the pressures of those who see monetary policy as a tool for popularity.

In the end, what we call “independence” is often technical resistance within a dysfunctional system.

Conclusion: Formal autonomy, structural dependence

The true independence of the Central Bank is not measured by law — but by context.

While:

- The government uses public spending as electoral currency,

- Congress treats the budget as a counter,

- And society blames interest instead of deficit,

…the Central Bank will only be a wall surrounded by fire.

Autonomy of mandate is not enough.

Context autonomy is needed — and this will only come with fiscal responsibility, political maturity and pressure from society.

📩 Do you want to understand how monetary decisions affect your pocket, your freedom and the future of the economy?

Subscribe to the Economic Radar newsletter and receive direct analysis and criticism in your email.