The Ibovespa ended April up 3.69%, according to the survey by Value Invest, accumulating the best monthly performance since December. The main newspapers highlighted the inflow of foreign capital as a driving factor, in addition to the apparent truce in the tensions of the global trade war. However, this optimistic picture of the stock market contrasts with the persistent weakness of the national currency. According to CNN Brazil, even with the slight drop in the dollar against the real at the end of the month, the exchange rate remains under pressure, and the macroeconomic scenario remains volatile.

In this article, we analyze what is really behind this apparent disconnect between the stock market euphoria and the fragility of the real. Is the market pricing in a real recovery? Or are we facing yet another speculative cycle fueled by high interest rates and volatile capital flows?

The appreciation of the stock market: external effect or internal confidence?

This is not the first time that the Ibovespa has risen while the real has depreciated. This dichotomy has been common in recent years, especially in periods of political instability or fiscal distrust. The movement in April is largely the result of the inflow of foreign resources seeking interest rate arbitrage and discounted assets — that is, buying assets in a country with lower prices or higher interest rates and profiting from the difference compared to other markets — not a vote of confidence in the solidity of the Brazilian business environment.

The rise in shares of Petrobras, Vale and banks pushed the index higher, but this reflects much more the composition of the index and commodity prices than a broad economic recovery. Industry remains stagnant, consumption is sluggish and domestic investor confidence indicators remain weak.

The weak real reveals structural fragility

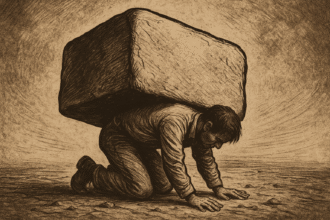

While the Ibovespa is rising, the real remains one of the most unstable emerging currencies. This is not just a reflection of the trade war or external decisions — it is a direct consequence of an economic policy that undermines the credibility of the national currency.

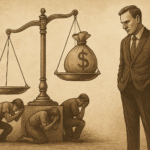

As we analyzed in “While the dollar rules, the real obeys”, the loss of value of the real is the result of persistent public deficits, artificial monetary expansion and recurring interference in market fundamentals. Foreigners who buy shares in Brazil know this — and, therefore, enter into currency hedging or quickly repatriate profits — currency hedge is a protection against currency fluctuations, used to ensure that any gains in reais are not lost due to devaluation against the dollar. Capital is speculative, not constructive.

Brazil as a destination for arbitration, not trust

The difference is crucial: there are countries that attract productive, long-term investment, and there are countries that become arbitrage platforms. Brazil today fits into the second group. Stock market gains do not mean job creation, increased income or economic dynamism. They only mean that there is room for quick profits, in an increasingly fragile institutional environment.

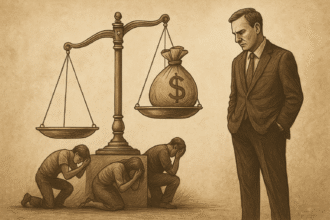

This reality is revealed by the real economy's own data. As we show in “The false neutrality of state currency”, the expansion of public credit and control of the currency are used not to boost growth, but to sustain state privileges and shield bureaucratic elites from the crisis.

Does the market ignore structural inflation?

While analysts celebrate the partial recovery of stock indexes, inflation forecasts for 2025 remain above target. The Focus bulletin still points to something around 5.5% per year — well above the official target, which is 3%. This shows that inflationary pressure is persistent and that the Central Bank operates under strong political tension.

The rise in the Ibovespa does not correct the reality felt by the population: the real remains weak, food remains expensive, and real wages continue to be eroded. In “The new invisible tax”, we show how inflation works as an income transfer mechanism — from the poorest to the State.

The bubble of optimistic narrative

Growth narratives based on rising stocks are common in unstable economies. But the real test is what’s behind the appreciation. When stock market growth is driven by fundamentals—rising productivity, legal certainty, fiscal responsibility—it is often accompanied by a strong currency and long-term stability.

In the Brazilian case, we are seeing the opposite: a rising stock market with a weak currency, high inflation, a growing tax burden and a decline in business confidence. As we discussed in “The invisible expansion”, the State expanded its influence over the productive sector without any transparency, draining resources and discouraging real investment.

Conclusion: What is the market really telling us?

The market is not optimistic. It is simply operating with the tools it has. The rise in the Ibovespa does not mean a shift in investor confidence — it just means that, even in a hostile environment, there is still room to make money with Brazilian assets.

The true diagnosis lies in the exchange rate, inflation, blocked credit and the flight of productive capital. The weak real is the portrait of a country that spends more than it collects, that taxes more than it produces, and that prevents the generation of wealth with bureaucracy, instability and interventionism.

📩 Do you want to understand how the market reacts to politics and why this directly affects your pocket?

Subscribe to the newsletter Economic Radar and receive our analyses directly in your email.