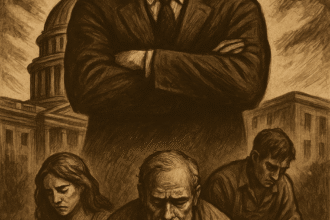

“The State is the great fiction by which everyone tries to live at everyone else's expense.”

—Frédéric Bastiat

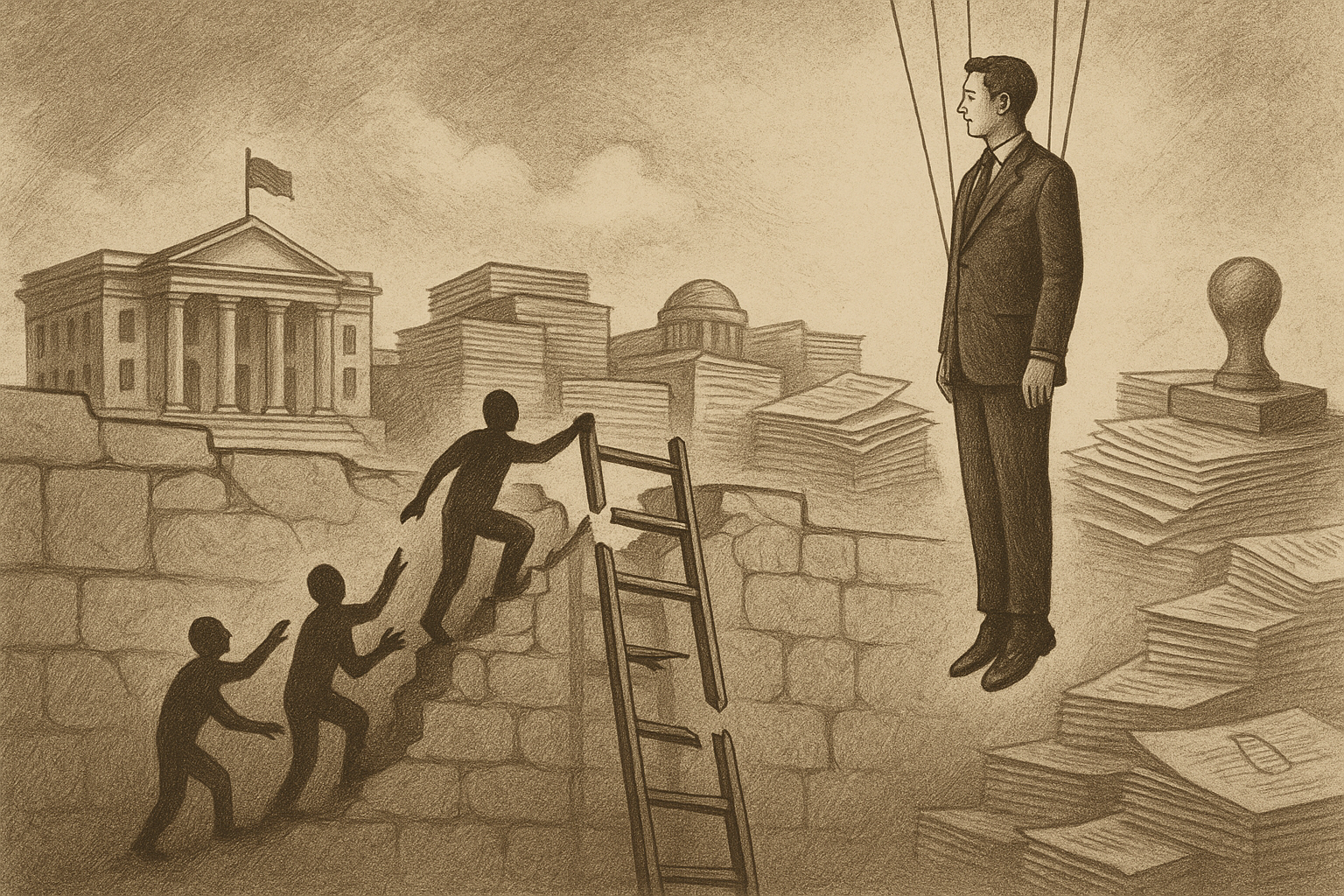

Social inequality is used as a justification for expanding state control. The rhetoric is familiar: without government intervention, the rich would become even richer, and the poor would become increasingly exploited. This discourse, which has structured public policies and redistribution programs for decades, is based on a convenient — but deeply mistaken — premise. What it ignores, or hides, is that the state not only tolerates inequality, but is the main agent that produces and sustains them.

We are not talking here about the natural inequality between talents, efforts and choices. What is at stake is an inequality artificially manufactured by laws, subsidies, legal monopolies and ties to power. An inequality structurally protected, which transforms bureaucrats into aristocrats and state entrepreneurs into heirs of unproductive castes. The problem is not the market. The problem is when the market is captured.

Wealth by merit versus wealth by privilege

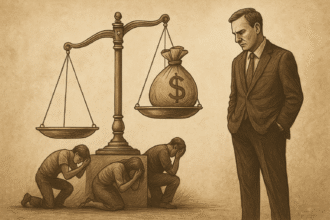

It is essential to distinguish two types of wealth:

- The first is generated through merit: through work, innovation, creativity, savings and voluntary exchanges. It is the wealth that emerges from economic freedom and competition. It is not only legitimate, but also beneficial to everyone, as it arises from efficient solutions that improve people's lives.

- The second is wealth by state privilege: obtained through public contracts, granted monopolies, regulations that prevent competition, targeted tax exemptions and public financing. This is anti-meritocratic wealth, sustained by coercion and imposed on the taxpayer.

The dominant narrative mixes the two to justify intervention. But the real driver of inequality It's not the free market — it's the symbiosis between interest groups and state power.

The state elite and the captive businessman

Brazil offers a fertile field to observe this process. The so-called “crony capitalism” is the tropical version of the oligarchy disguised as a market. The case of construction companies that have become rich with billion-dollar public contracts is not an exception — it is the rule. Banks that profit from Treasury bonds, technology companies that live off bidding, “non-profit” organizations that make millions from agreements.

They are not competitors in the market — they are government customers. The government becomes the great distributor of opportunities, and merit is replaced by connections. It is in this environment that the “state capitalist” thrives. He does not need innovation, he needs institutional stability to maintain his share of the budget.

Functionalism as an armored caste

One of the most visible forms of this manufactured inequality is in the upper echelons of the civil service. While the productive population faces instability, rising taxation and difficulty saving, thousands of elite civil servants live under legal stability, permanent bonuses, extended vacations and full retirements.

The article The Fiscal Elite: How High-Ranking Civil Servants Survive the Crisis shows how this caste remains untouched in any crisis. Inequality in this case is not just about salary — it is also about risk. A high-level civil servant lives in a different Brazil: protected, well-paid, and disconnected from the country's fiscal reality.

Selective subsidies: institutionalized distortion

The policy of sectoral subsidies is another driver of inequality. In the name of “strategic development”, the State transfers public resources to specific companies, via BNDES, tax incentives or debt forgiveness. The result is an economy in which access to the budget is worth more than business competence.

These practices discourage competition and turn the market into a rigged game. Small companies, without access to public favor, compete at a disadvantage. And large companies, protected, lose the incentive to be efficient. The discourse of “help” to the productive sector hides a system of freezing of economic mobility, where the winners have already been chosen.

The tax structure as a barrier to advancement

It’s not just privilege that creates inequality — it’s also burden. Brazil’s tax structure is regressive, complex, and punitive. The average citizen, small entrepreneur, and informal worker face a disproportionate burden of taxes and bureaucratic obligations.

The article Tax to Ban: How Taxes Discourage Freedom Without Taking Responsibility deals with this clearly. Many people are unable to even formalize a small business. The consequence is obvious: the State pushes millions into informality while closing the top of the economic ladder to new competitors.

The invisible role of regulations

In addition to taxes, excessive regulations act as a barrier for those who want to start or expand a business. There are technical requirements, licenses, registrations, health, environmental, tax and labor standards that overlap and make it impossible for smaller businesses to grow.

Large companies have the structure to deal with this. Small companies don't. Result: state regulation becomes an instrument of market concentration, reversing the logic of “protecting the consumer” to that of eliminating competition in the name of bureaucracy.

The game was rigged from the start

The rhetoric of inequality misses the main point: the game is already rigged from the start. Access to credit, justice, quality education, and entrepreneurship are all shaped by political decisions. And these decisions always favor the same groups.

The ordinary citizen, who depends on neutral institutions, is at a disadvantage. The well-connected, on the other hand, is always one step ahead — not by merit, but by power projects.

Conclusion: Equality in Liberty, Inequality in Privilege

There is no true equality under a system that rewards political connections and penalizes individual initiative. True social justice arises from freedom: when everyone can compete on equal terms, and wealth is the result of merit, not favors.

Combating inequality therefore requires, less State and more real market. Not a captured market, but a free market, where the rules are clear, privileges are undone and success depends on the ability to serve others, not on pleasing the ruler.

We need to break with the farce that the State is the defender of the poor. In practice, it has been the greatest manufacturer of real and lasting inequality

If this content made sense to you, share it. Criticism of inequality must begin by recognizing the true author of this distortion: the State.

Subscribe to the newsletter Economic Radar to receive new analyses and exclusive series directly to your email.