The typical headline reads: “US inflation slows, fueling optimism in markets.” But a closer look reveals that this apparent good news hides a much more worrying economic reality.

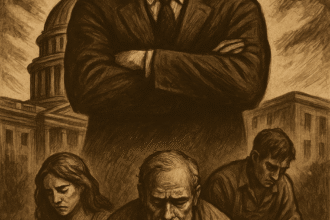

Since the beginning of Donald Trump's second term, the United States has followed a predictable script: increased public spending, selective tax cuts and a nationalist industrial policy that recalls the worst of the 1970s. All of this fueled by billion-dollar deficits and a public debt that already exceeds 34 trillion dollars.

The slowdown in inflation was not due to structural reforms, fiscal restraint or monetary austerity. It is, in fact, the reflection of an inflated comparative base and lagged effects of the previous rise in interest rates. The Federal Reserve raised interest rates, yes — but the government kept spending like there was no tomorrow. What's more, the labor market remains artificially buoyed by government incentives and benefit programs that mask the economy's true productivity.

In the short term, the indexes can be misleading. Inflation slows in certain sectors, but food, energy and housing are still on the rise. The dollar, although momentarily stable, is suffering from growing global distrust. And gold, the asset par excellence for protecting against inflation and uncertainty, has just reached historic highs.

A cold reading of the numbers is not enough. We need to ask: What is behind inflationary relief?

Are we really returning to stability — or are we just delaying the inevitable bursting of a bubble built on easy money, protectionism and economic populism?

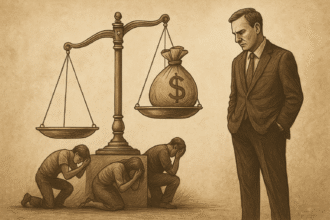

As Ludwig von Mises warned,

“Whatever the government gives to one, it must first take from another.”

And that someone will ultimately be the average citizen — whether through visible taxes or, more insidiously, through inflation disguised as growth.