Brazil seems to have accepted the deficit as part of the political landscape. But living forever in the red is not a sign of fiscal maturity — it is a confession of moral bankruptcy.

In this post, we will analyze how the fiscal deficit has become a political vice, an instrument for perpetuating power and a silent time bomb that threatens the country's freedom and economic future.

👉 Read also: The Bureaucracy Machine Never Stops (link to corresponding post)

The deficit as a state policy

In economics textbooks, the public deficit — when the government spends more than it collects — is treated as something exceptional, a one-off response to temporary shocks, such as wars, pandemics or catastrophes. In Brazil, however, it has become a permanent practice.

Year after year, government after government, administrations of all ideological stripes accept deficits as normal. They correct the accounting with tricks, create parallel funds, push forward future payments to buy immediate political victories.

The result? A country where fiscal irresponsibility is institutionalized, and punishment for mismanagement is passed on to future generations.

Why the deficit is so convenient for rulers

Governing with a deficit is politically comfortable:

- It allows you to increase spending without the unpopular cost of raising taxes immediately.

- It enables electoral programs and works, often financed by public debt that is invisible to the average voter.

- It feeds sectors dependent on the State — companies, unions, bureaucratic corporations — which, in return, guarantee political support.

It is a vicious cycle: the government creates dependency in the name of social inclusion or development, and then uses this dependency to justify more government, more spending and more deficit.

The deficit thus becomes an instrument of power, not necessity.

The invisible cost: inflation, interest rates and stunted growth

The average Brazilian does not feel the deficit in the technical language of the National Treasury. He feels it at the supermarket, when financing a car, in his salary eroded by inflation.

When the government spends more than it collects:

- Increases public debt.

- It puts upward pressure on interest rates.

- It degrades confidence in the currency.

- It reduces the space for private credit.

- It drains resources that could finance innovation, productivity and sustainable growth.

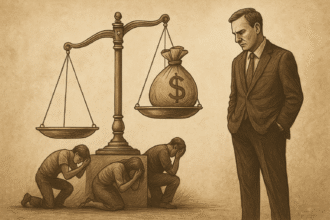

Deficits are deferred taxes. And like all taxes, they fall more heavily on those who do not have access to privileges: the common worker, the small entrepreneur, the young person who has not yet found a job.

The eternal excuse of “social necessity”

Defenders of chronic deficits always appeal to the emotional argument: “you cannot cut spending in times of crisis”, “it is necessary to invest in social programs”, “there is no alternative”.

This rhetoric ignores that:

- Many social programs are poorly managed, with shameful rates of waste and fraud.

- Bad investments increase debt without generating economic returns.

- Cut privileges, perks and cross-subsidies could open up fiscal space without sacrificing essential policies.

But changing these points requires political courage — something that is scarce in environments where short-termism is the rule.

Countries that faced the deficit and won

Deficits are not an inevitable fate. Countries such as Ireland, Estonia, Chile and even post-reunification Germany have undergone periods of deep fiscal adjustment — and are now reaping the rewards in the form of growth, international credibility and monetary stability.

These countries understood that:

- Spending responsibly is not “cruel neoliberalism” — it’s protecting the future.

- Sustainable growth requires a solid fiscal base.

- Austerity is not about cutting basic services — it is about cutting waste and retooling the state to serve better.

Brazil could also follow this path. But to do so, it would need to break the tacit pact that turns the Treasury into an ATM for interest groups.

Meanwhile, the people pay the bill

The discourse of “social necessity” hides the harsh reality: people pay twice.

First, it pays with taxes — direct and indirect, visible and hidden. Then, it pays with the deterioration of public services, inflation disguised as growth, and lost opportunities for real prosperity.

The deficit is not just a fiscal problem. It is an ethical problem. It is the institutionalization of political cowardice, the admission that governing in the short term is more important than building a country for the long term.

Conclusion: Either we confront the deficit culture, or it will swallow us

Each year of chronic deficit is a brick in the wall that separates Brazil from its true economic power.

Every emotional justification is a push towards the abyss of stagnation.

Fiscal responsibility is not the enemy of social justice — it is its prerequisite.

Without balanced public accounts, there is no freedom, no growth, no possible dignity.

The State that never learns is also the State that never evolves.