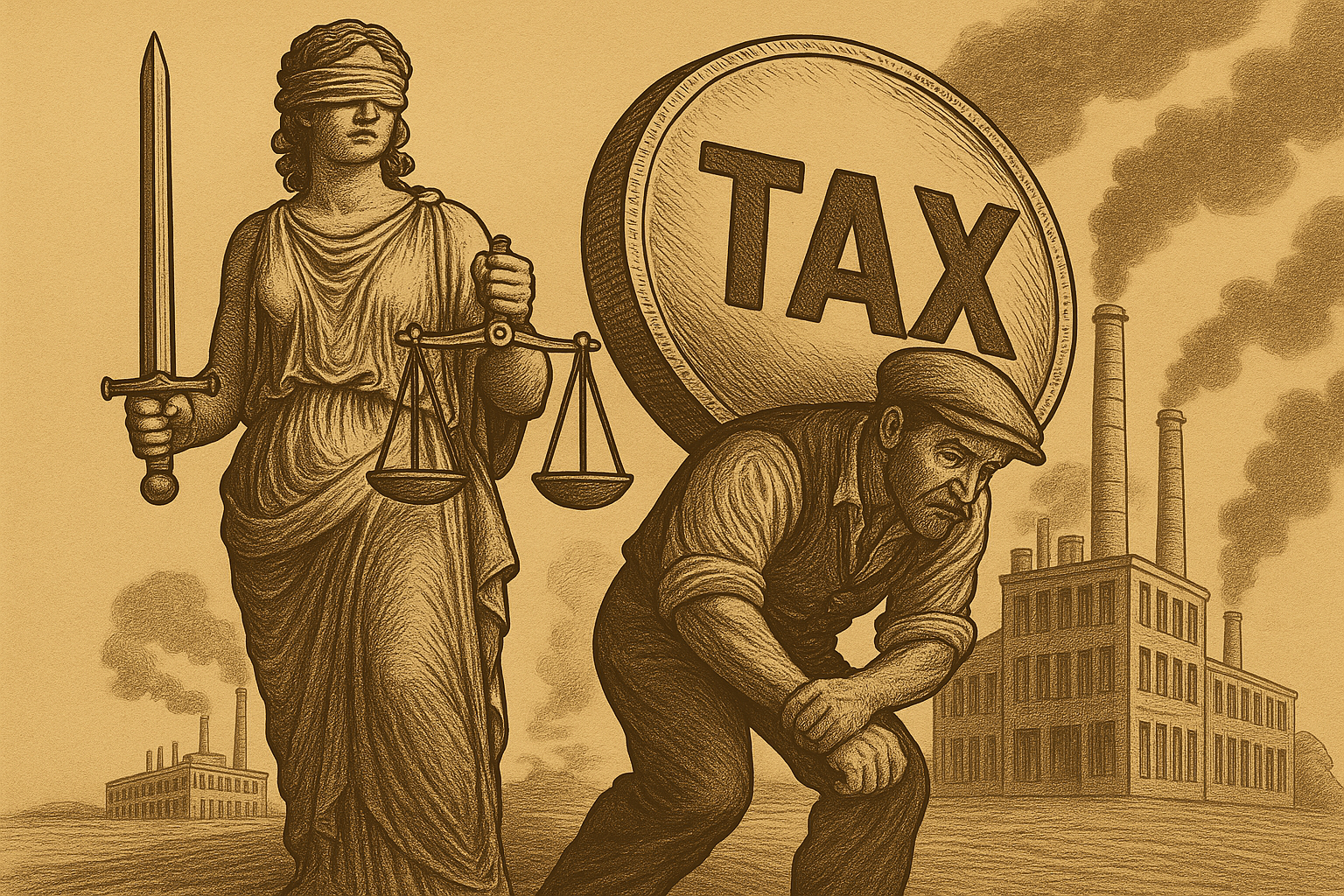

“Taxation is the price of civilization” — say the defenders of the bloated State. But in Brazil, where the citizen works until May just to pay taxes, the reality is closer to a budgetary sequestration than to a civilizing pact. With every product purchased, every salary received, every service contracted, there is an invisible (but violent) slice of the State taking its share — regardless of delivery.

And what does the Brazilian receive in return? Collapsed hospitals, schools on strike, potholed roads, public insecurity and institutionalized corruption. In the country with the highest tax burden among emerging countries, the tax is less a voluntary contribution to the common good and more a legalized extortion, supported by the monopoly of force.

Read also: the article The selective legality of the State: repression for the weak, forgiveness for the strong, which shows how the law is applied strictly to the little ones while protecting the big ones; and the text Billion-dollar subsidies, popular inflation: the (in)visible bill for “state aid”, which reveals how the State transfers resources from the people to privileged sectors under the pretext of economic incentives.

The unsustainable weight of the tax burden

According to a study by InvestNews, the tax burden in Brazil reached 33.7% of GDP in 2022, one of the largest among emerging countries — even surpassing the Latin American average, which is around 22%.

THE Economic Value highlights that this index reached the highest level in the historical series - even so, the Brazilian government remains without a primary surplus, that is, without saving even to pay the interest on the debt.

I.e: More is collected than ever, but the deficit continues to grow. This reveals the essence of the problem: the Brazilian State is not sustainable — it is insatiable.

The worst tax return in the world

According to the global ranking prepared by World Taxpayers Associations, published in G1 and in the InvestNews, Brazil is among the worst countries in the world in returning taxes to the population in the form of services.

Even with very high revenue, Brazil occupies the last positions in the efficiency index — behind countries such as Peru, Bolivia and Paraguay.

This means that Few countries charge as much and return as little as Brazil. For every real that a citizen pays, he receives crumbs — if he receives anything.

A regressive, inefficient and opaque system

The burden of taxes is not distributed fairly. Brazil adopts a model regressive, where most of the revenue comes from consumption — which penalizes the poor proportionally more. An informal worker, who cannot escape the embedded taxes, pays proportionally more than large groups with access to sophisticated tax planning.

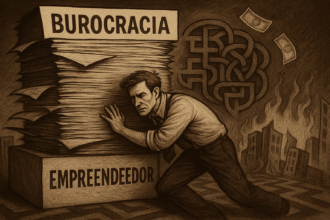

Furthermore, the system is unjustifiably complex: there are more than 60 different taxes, with thousands of accessory obligations. This is not a coincidence — it is political project. The confusion favors the big ones, who can afford consultants, and punish the little ones, who live at the mercy of arbitrary fines and citations.

Tax morality is dead

Defenders of the State insist: “If you like ambulances, schools and street lighting, then don’t complain about taxes.” But this emotional blackmail ignores the obvious: It's not about paying — it's about what you do with what you pay for.

It is immoral to demand 33% of the national wealth if that wealth is consumed by patronage, waste, inefficient state-owned companies, corruption and parasitic bureaucracy. It is immoral to arrest someone for not correctly declaring a tax obligation — while politicians forgive billions in debts of large companies and banks linked to power.

The Brazilian works 5 months to support the Leviathan

According to the study Days Worked to Pay Taxes 2024, from the Brazilian Institute of Planning and Taxation (IBPT), the Brazilian taxpayer had to work until the May 28, 2024 only to pay taxes, fees and contributions required by the federal, state and municipal governments. This amounts to 40,71% of your average annual income — a rate that not only reveals the weight of the Brazilian tax system, but also its aggressiveness on the income of the common worker.

It's 2025, and nothing seems to be improving: the tax effort continues to grow, the return remains meager, and the official rhetoric continues to ignore the brutal imbalance between what is paid and what is received.

This is the cost of forced citizenship: half the year dedicated to feeding a public machine that returns inefficiency, delay and oppression.

The narrative of civilization and the reality of plunder

The phrase “taxation is the price of civilization” has been hijacked to justify any level of taxation. But what defines a civilization? It's not how much she charges — it's what she gives back.

In Sweden or Norway, where taxes are also high, the services are of high quality, the system is transparent and the return is visible. In Brazil, high taxes sustain privileged castes, and the services are mediocre.

Here, tax is the price of the survival of the State itself — not of society.

Tax as coercion — not as contribution

What makes Brazilian taxes particularly odious is the fact that they are charged under threat. This is not a voluntary contribution. It is an obligation imposed under penalty of fine, blockage, imprisonment or exclusion from the formal market.

And who suffers the most? Entrepreneurs, formal workers, self-employed workers and micro-entrepreneurs. The informal sector is persecuted. The MEI is suffocated. And the State's major debtors negotiate, pay in installments and protect themselves.

Read also: the article Entrepreneurship in Brazil: where bureaucracy is the biggest competitor, which exposes how the tax and regulatory system suffocates those who try to produce; and the text Consumer law or weapon against the market?, which reveals how legislation, under the pretext of protection, serves to exclude the small and shield the large.

When the citizen is suspicious by default

The Brazilian tax system assumes that citizens are potential tax evaders. Therefore, it requires them to declare, prove, justify, issue, register and pay — even without knowing why.

This presumption of guilt serves one purpose: increase state control over society. The Brazilian tax system is not just about collecting revenue — it is disciplinarian. It keeps the citizen under constant surveillance and at the mercy of arbitrary interpretations of the law.

Conclusion: robbery? Extortion, at the very least

For a committed libertarian, the statement that “taxation is theft” is not just a slogan—it is a moral diagnosis. After all, it is the forcible appropriation of another’s property by an entity that sustains itself through coercion. But even if you do not share this radical premise, It is impossible to ignore that, in Brazil, taxation is dangerously close to extortion. After all, it is money taken by force, with minimal return, legitimized by an institutional apparatus that lives off opacity.

The problem is not the tax itself — it is the Brazilian tax model: inefficient, unfair, regressive, opaque, coercive and corrosive. It does not sustain civilization. It sustains a state that has failed to fulfill its role.

📩 Do you want to understand how the Brazilian tax system destroys your purchasing power and freedom?

Subscribe to the newsletter Economic Radar and receive weekly analyses on taxes, bureaucracy and how the State feeds off your efforts.