“The rich need to pay more taxes.”

“Tax justice means charging more from those who have more.”

“Strong state to guarantee equal rights.”

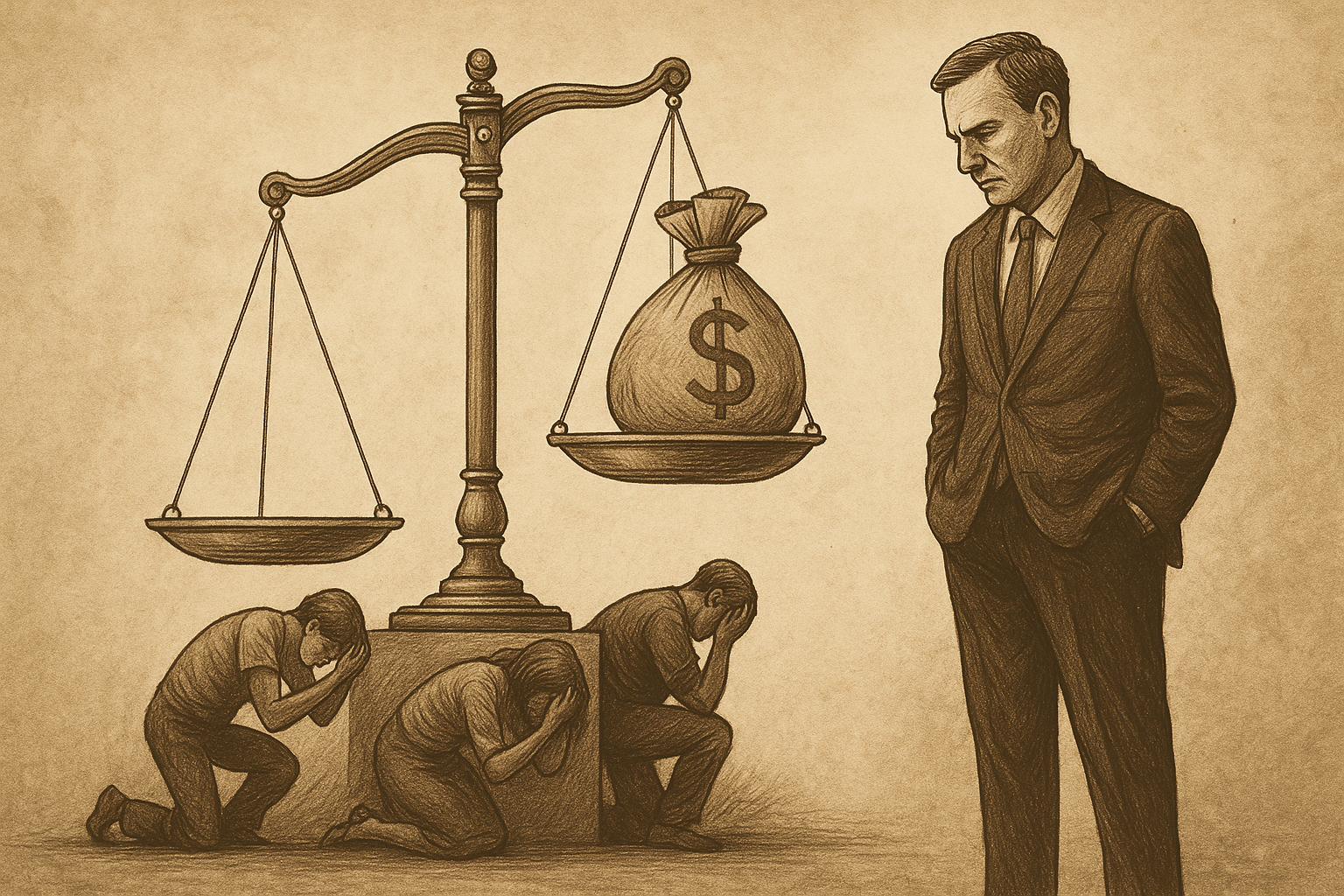

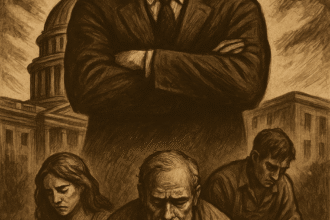

These phrases make up the modern mantra of tax policy — always in the name of justice, equality and the collective good. The problem? They mask a power project, not justice. The discourse of tax justice has become a tool for increase revenue, expand state control and covertly punish individual freedom.

This article will demonstrate why the rhetoric of tax justice is not neutral, nor harmless. It serves a purpose: legitimize the concentration of power in the hands of those who tax, while criminalizing those who try to escape the siege. Tax justice, in Brazil and in much of the world, is not justice — it is coercion disguised as virtue.

The concept of tax justice has been manipulated since its inception

The original notion of fiscal justice was linked to proportionality and simplicity. Each person would contribute the minimum necessary to support the essential functions of the State — security, contracts, defense. There was no intention of forcibly leveling society. Justice was given in the equity of duties and in the freedom of choices.

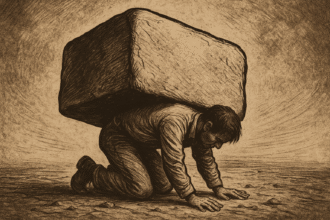

Over time, this concept was corrupted. It came to mean compulsory income redistribution, as if inequality itself were a crime — and the State a legitimate moral agent to correct it. But this state morality hides a contradiction: There is no justice in confiscating the fruits of some people's labor to support the privileges of others.

The political use of progressive taxation

One of the pillars of so-called tax justice is progressive taxation. The idea is simple: the more you earn, the higher the tax rate. But in practice, what we see is that:

- The middle and productive class bears the greatest burden.

- Large fortunes are protected by tax planning.

- Extra revenue does not finance the poor — finances the State.

In the article Tax to Ban: How Taxes Discourage Freedom Without Taking Responsibility, we demonstrate that taxation in Brazil is not just heavy — it is unequal, chaotic and instrumentalized to punish entrepreneurship and protect bureaucracy.

Tax justice, in this context, becomes a statist justice, where the virtue is in paying a lot and the blame falls on those who try to escape the machine.

The true destination of the collection: privilege, not equity

The central argument of tax justice is that the money collected will be returned to the poorest. But the Brazilian reality shows the opposite:

- The bulk of the proceeds go to pay the public machine

- Party funds, salaries above the ceiling, deficit-ridden state-owned companies

- Most social spending goes to inefficient transfers or operating costs

There is no institutional Robin Hood. What there is is a Hungry Leviathan, which consumes more and more resources to maintain its tentacles — and demands moral sacrifices from those who only want to retain part of what they have produced.

Criminalization of tax freedom

Modern tax justice does not stop at collection. It advances over the language, reputation and moral legitimacy of those who question the model. Terms such as:

- “Aggressive elision”

- “Abusive tax planning”

- “Unfair tax competition”

- “Tax haven”

… are used to criminalize the attempt to defend property. Instead of simplifying the system and making it fair by nature, the State makes everything opaque, confusing and morally inverted.

Those who seek efficiency are treated as tax evaders. Those who seek freedom are accused of lacking solidarity. Tax justice becomes a state religion — and those who do not believe are heretics.

The hidden price of tax justice: control

The discourse of tax justice is not just about collecting revenue. It aims to control. The tax system is used as a tool for monitoring financial transactions, consumption, investments, assets and inheritances.

The promise of equality serves as pretext to break confidentiality, invade privacy, track transactions and repress decentralized initiatives. The ordinary citizen finds himself faced with a State that, in the name of justice, demands unrestricted access to his financial life — and punishes him if he deviates from any norm.

This control environment is analyzed in The False Neutrality of State Money: Whoever Controls the Money, Controls You, where we show that state money already serves power more than the economy. Taxation follows the same path.

Tax Justice Rhetoric Protects the State — Not the People

The state claims to fight inequality. But the inequalities that matter most — access to power, functional stability, legal privileges and institutional protection — remain untouched. Tax justice does not reach:

- High salaries in the Judiciary

- Public funds for parties and state-owned companies

- Inefficient and unaccountable bureaucracies

What it achieves is the average taxpayer, the small entrepreneur, the citizen who tries to prosper without state favors. For him, there is always another tax, an obligation, a guilt.

Conclusion: justice without freedom is just control with a nice name

Tax justice, as it is applied today, does not free — it imprisons. It does not promote equality — it perpetuates dependence. It does not empower — it monitors. And its real function is to keep the power to tax where it has always been: in the hands of those who will never be taxed with the same weight.

This farce must be exposed. Defending a fair system is defending a system simple, proportional, transparent and with clear limits on the power to tax. Real justice demands freedom — not forced submission to state narratives.

📩 Do you want to understand how tax justice became a justification for economic coercion?

Subscribe to the newsletter Economic Radar and receive critical, straightforward analysis like this every week.