For centuries, money was a reliable instrument of exchange, emerging spontaneously from human interactions. Gold, silver, salt, stones—all were used because they were scarce, divisible, and recognizably valuable. But at a certain point in history, the state decided to take control of money. Not as a neutral custodian, but as the sole author and beneficiary of its value.

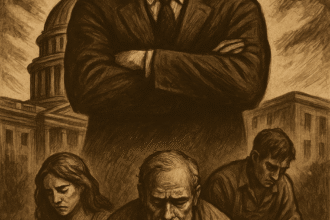

From then on, money ceased to be a tool of society and became a weapon of power. The illusion of monetary neutrality — that the State only issues and regulates — hides one of the most perverse mechanisms of contemporary domination: the manipulation of currency as an instrument of fiscal coercion, arbitrary redistribution and economic dependence.

In this article, we will examine why state currency is not neutral, how it became an instrument of political domination, and why those who hold the monopoly on issuance also hold control over the economic future of individuals.

Money as a spontaneous social contract

Monetary history reveals that money was not an invention of governments but a natural result of trade. As societies began to exchange goods, they found that certain items were more acceptable than others—precious metals, for example, because of their scarcity and portability. Ludwig von Mises, in his Theory of Money and Credit, demonstrates that money emerges spontaneously from the market.

This voluntary origin reinforces its original function: to facilitate exchanges, preserve value and measure prices objectively. The currency was reliable because it was beyond the will of those who governed.

This changed when states began issuing legal tender money, taking away from society the right to choose what is currency. Trust is no longer based on intrinsic value and has become dependent on political promises.

The illusion of neutrality: printing without consequences?

From the 20th century onwards, with the rise of central banks and the abandonment of the gold standard, governments began to have unrestricted issuing power. State currency has become pure paper — or, in the digital world, just numbers in a system controlled by a monetary authority.

This transformation was sold as a technical breakthrough. It promised flexibility, growth, stability. But it delivered. chronic inflation, credit bubbles, artificial cycles of prosperity and crisis, and a system in which those who first receive newly issued money have a clear advantage over others.

The call monetary neutrality — the idea that printing money only affects prices but does not distort the real structure of the economy — is a fiction. The Austrian School demonstrates that new money never enters the system uniformly. It changes relative prices, redistributes income, and directs investment in an artificial way.

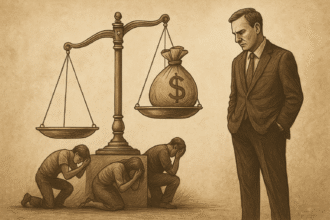

Who benefits from inflation?

The State, banks and economic groups closest to power are the first to receive the new money — before prices rise. This allows them to buy assets, land, contracts and salaries with artificially inflated purchasing power.

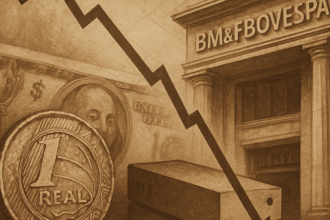

Salaried workers, savers, retirees and small entrepreneurs are the last to feel the impact — with prices already higher, but incomes still lagging. The result is a systematic process of wealth transfer: from those who produce to those who print.

This phenomenon was discussed in the article “Nintendo and price localization – the problem isn’t the game, it’s the currency”, where we analyze how the devaluation of the real, caused by internal monetary decisions, directly affects Brazilians' access to global products.

It’s not just about “the currency being weak” — it’s about a silent sabotage of the population's purchasing power, carried out in the name of supposed macroeconomic objectives.

Debt as a control mechanism

Another fundamental point: unbridled issuance feeds public debt. The State begins to finance its deficits not with visible taxes, but with disguised inflation, which erodes income without needing to go through Congress. It is the most silent form of taxation.

Debt, in turn, imprisons the economy. When the government becomes the largest debtor, the Central Bank starts working to keep the cost of that debt low — even if that means keeping interest rates artificially low, inflating bubbles or postponing inevitable adjustments.

In this context, monetary policy ceases to serve stability and becomes a service to the Treasury. The Central Bank becomes an appendage of fiscal power, and the common citizen becomes hostage to decisions that you don't control, but that affect every penny you earn or spend.

State currency: a tool of centralization

State control over the currency also generates institutional centralization. Since everything depends on trust in monetary policy, regulation of banks, payment systems and even cryptocurrencies increases. The State creates barriers to anything that represents competition to its monopoly.

The argument is always the same: security, stability, fighting crime. But the practical effect is the curtailment of financial freedom. Citizens can no longer protect their assets without authorization — or without running the risk of punishment.

When the currency becomes a watchdog

With the digitalization of state currencies, control goes beyond issuance. Tracking becomes a reality. The so-called CBDCs (Central Bank Digital Currencies) promise agility and inclusion, but offer the State the unprecedented capacity to:

- Block payments;

- Monitor consumption habits;

- Impose financial penalties;

- Limit spending based on political criteria.

Currency ceases to be an instrument of exchange and becomes obedience mechanism. Whoever controls the money, controls the behavior.

The path of decentralization

The only viable alternative is to restore the voluntary nature of the currency. This means making room for monetary competition, as Hayek argued. It means allowing individuals to choose how to preserve their value: in gold, in cryptocurrencies, in decentralized assets.

It means, above all, accepting that a fair monetary system cannot be controlled by those who benefit from the lack of control.

Money must once again become an expression of real value — not a political fiction manipulated every election cycle.

Conclusion: the State is not neutral — and its currency even less so

State currency is not a neutral tool of economic policy. It is an instrument of power. It allows the government to expand its spending without accountability. It allows privileged groups to capture value before the population realizes it. And it serves as a barrier to the financial autonomy of millions.

Currency devaluation, permanent debt, inflation and digital control are not failures. These are characteristics of a system designed to keep the common citizen in a position of dependence.

We need to break with the idea that money issued by the State is a public good. In practice, it is a mechanism of domination — disguised as stability.

If you believe that freedom begins with your wallet, share this article. Question the legitimacy of the state monopoly on currency. Protect your income, your purchasing power, and your autonomy.

Subscribe to the newsletter Economic Radar and receive new articles and special series directly to your email.