When we think of prohibitions, the image that comes to mind is of explicit laws: “no smoking”, “no selling weapons”, “no selling drinks”.

But the modern state has developed a more subtle—and cowardly—method of limiting freedom: the punitive tax.

Without having to face the political burden of enacting a formal ban, the government simply taxes products or behaviors until they become unaffordable.

It is prohibition through fiscal asphyxiation.

Punitive taxes: censorship in disguise

When the government wants to discourage something — but doesn't want to face the unpopularity of a prohibitive law — it simply raises the tax to the point where consumption is impossible.

Practical examples:

- Cigarettes: Extremely high taxes did not eliminate consumption, but they fueled smuggling and enriched organized crime.

- Fuels: Taxes on gasoline and diesel make transportation more expensive, penalizing workers and the productive sector — but the State blames the “market” for the price increase.

- Imported products: Abusive pricing doesn't protect jobs—it protects inefficiencies and punishes consumers.

Result:

The government “washes its hands” while destroying freedom of choice.

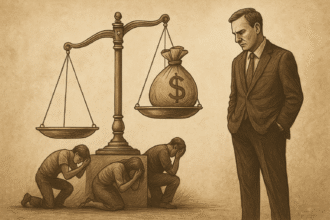

Selective Disincentive: Freedom for Some, Coercion for Others

This practice creates a society of economic castes:

- Those who can pay, continue consuming.

- Those who can't, are forced to give up.

Freedom becomes a privilege — not a right.

And the State, while defending “social justice” in its discourse, reinforces inequalities in the market.

The perverse cycle of the moralistic tax

The punitive tax generates:

- Black market (as in the case of cigarettes and drinks).

- Reduction in official revenue.

- Increase in corruption and smuggling.

- Damage to national competitiveness.

In other words, in addition to restricting freedom, the State creates more problems than it solves — and still demands more power to combat the consequences it itself caused.

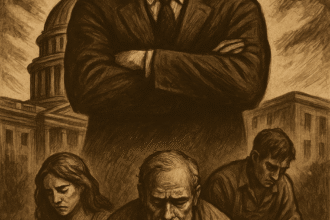

Tax as a tool of social engineering

Ultimately, this strategy reveals the true arrogance of the modern state:

It is not enough to collect revenue to finance services — the State wants shape behaviors and discipline choices.

And he does it by charging a lot.

Taxing is not just financing: it is regulating, limiting, controlling.

When taxes are not used to finance public administration, but to punish individual choices, they become a tool of economic censorship.

Conclusion: Real freedom requires fair taxation

Freedom of choice is a pillar of a truly free society.

It cannot depend on the benevolence of those who govern — nor on the balance of the bank account.

Taxing to prohibit is a disguised form of authoritarianism.

If the State wants to prohibit it, it should have the courage to say so.

If you don't have that courage, respect freedom.

The price of freedom is vigilance against all forms of coercion — including fiscal coercion.

📩 Do you want to understand how the State uses taxes to control your choices?

Subscribe to the Economic Radar newsletter and receive critical analysis directly to your email.