Introduction

The recent announcement of Switch 2 game prices in Brazil — as Mario Kart World for R$ 499.90 — reignited heated debates about Nintendo's pricing policy.

Many YouTubers and commentators accuse the company of “greed” for not adapting its prices to the Brazilian reality.

But this view simplifies a much deeper problem.

The truth is that the big obstacle is not Nintendo — it is the fragility of the real, chronic inflation and the global risks involved in the so-called price location.

Let us explain in detail.

What is Price Localization?

Price localization means adapting the price of a product or service for different markets, taking into account factors such as purchasing power, local taxes and competition.

In theory, it seems like a fair solution.

In practice, it brings big risks for companies.

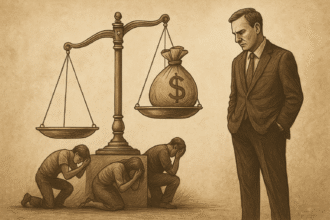

1. Loss of Global Revenue

Problem:

Lowering prices in weak currency countries reduces revenue in those markets.

Example:

If a game costs US$$ 70 in the US and R$$ 250 in Brazil, with the price and costs involved, the profit margin in Brazil could be negligible.

Even if more units are sold, the volume may not compensate for the unit loss.

Explanation:

Games have high fixed development costs.

Replicating digitally is cheap, but the support structure, translation, marketing and licensing needs to be paid for somehow.

2. International Arbitration Risk

Problem:

When prices differ greatly between countries, people use VPNs, alternative accounts, or the gray market to buy where it is cheaper and resell or use it in expensive markets.

Example:

Steam has suffered years of arbitration, forcing Valve to limit international purchases.

Impact:

This not only destroys the local market in the rich country, but also forces the company to review its global strategy — losing even more revenue.

3. Inflation and Exchange Rate Instability

Problem:

In countries like Brazil, even if the company localizes today, in a few months the real may depreciate — and localized prices become outdated.

Real example:

Many companies have had to readjust prices in Brazil in recent years due to double-digit inflation.

Impact:

It requires constant adjustments, which causes wear and tear on the brand and frustration among consumers.

4. Operational and Tax Complexity

Problem:

The business environment in Brazil is extremely bureaucratic and taxed.

Impact:

Even if prices are localized, the company may have to deal with very high taxes, making it difficult to maintain the promised low prices.

5. Brand Image and Value Strategy

Problem:

Companies like Nintendo don't just sell games. They sell tradition, prestige and exclusivity.

Impact:

Lowering prices too much can devalue your brand — especially in high-value markets like the US, Europe and Japan.

Key phrase:

Nintendo doesn't just sell games — it sells the value of being part of Nintendo culture.

Real Cases: Price Localization

🟢 Cases where it worked:

Steam (Valve)

- Localized prices in Brazil and other emerging markets.

- It worked because sales volume exploded, offsetting the lower margin.

- But it was necessary to tighten rules against international arbitration.

Xbox Game Pass (Microsoft)

- Price located in Brazil.

- Strategy focused on user base, not in immediate profit.

- It worked because the monthly subscription model dilutes the risk.

🔴 Cases Where It Went Wrong:

Netflix in Asian markets

- Very low prices in India and Southeast Asia.

- It increased the number of users, but severely reduced the average revenue.

- Result: losses and the need to readjust plans.

Epic Games Store

- Aggressive localization at launch in Brazil.

- Some developers pulled their games because the low price did not compensate for the expected revenue.

What about Nintendo?

Nintendo is extremely conservative.

Prefer to sell less, but preserve your margin and symbolic value.

Lowering prices in Brazil could:

- Delay launches (due to the need for renegotiations and logistics adaptations).

- Reduce margin without ensuring sufficient volume.

- Increase the risk of international arbitration.

- Weaken the brand's prestige globally.

I.e: It's not worth it for Nintendo's strategy.

Conclusion: The Problem Is Not Nintendo

The real problem is:

- Chronic inflation

- Devalued currency

- High tax burden

- Legal and exchange rate instability

Demanding that Nintendo solve Brazil's structural problems is like blaming the thermometer for the fever.

The real challenge is to build a healthy economic environment, where Brazilians' purchasing power is not eroded daily by poor fiscal and monetary management.

📩 Do you want to understand how the State destroys your purchasing power?

Subscribe to our Economic Radar newsletter and receive critical analysis on inflation, currency and the market directly to your email.